⚠️Lesson 2.3-Spotting Market Reversals: 3 Key Signals Traders Must Know

Knowing when the market is about to reverse can be just as important as identifying a good entry. Spotting reversals early can help you get in at the start of a new trend — or exit a trade before profits evaporate.

In this lesson, we’ll look at three powerful reversal warning signals:

-

Head and Shoulders pattern

-

Double Top/Double Bottom

-

Regular and Hidden Divergence

These tools are best used in higher timeframes to detect potential shifts, and then zooming into smaller timeframes for entry confirmation during pullbacks.

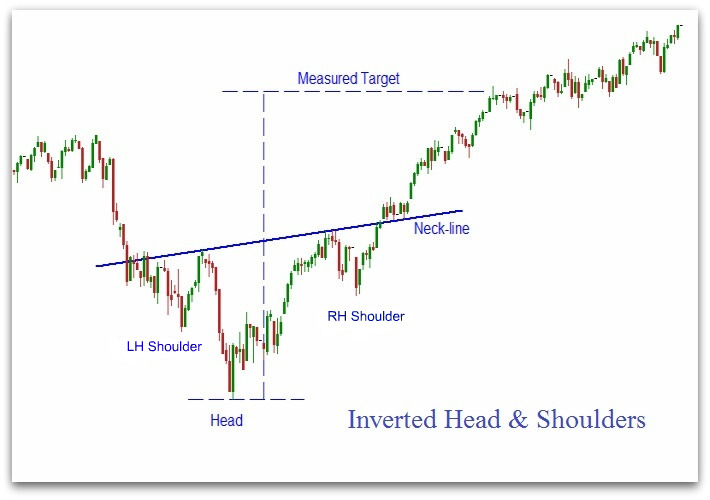

🧠 1. Head and Shoulders Pattern

The Head and Shoulders is one of the most well-known and reliable reversal patterns in trading. It indicates a trend is losing momentum and may be ready to reverse.

Structure:

-

Three peaks

-

Middle peak (the “head”) is the highest

-

Side peaks (the “shoulders”) are lower and roughly symmetrical

How to Trade It:

-

Draw the neckline by connecting the swing lows between the shoulders.

-

Wait for a break of the neckline. That’s your signal.

-

Ideal entries:

-

On the breakout

-

Or the retest of the neckline

-

Target:

Measure the distance from the top of the head to the neckline and project it downward from the break.

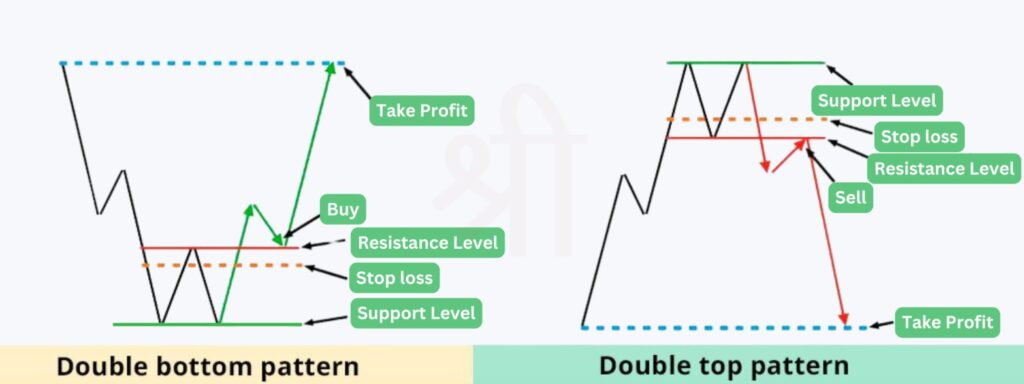

🔁 2. Double Top / Double Bottom

This reversal pattern occurs when price tests a key level twice but fails to break through.

-

Double Top = Two highs near the same level → bearish reversal

-

Double Bottom = Two lows near the same level → bullish reversal

Trading Tip:

-

Avoid entering immediately on the breakout.

-

Instead, wait for a confirmed break and retest or switch to a lower timeframe for refined entry.

Also, be mindful of stop hunts, where price slightly breaches the previous high/low to trigger stops before reversing. These can improve the reliability of the pattern if followed by a strong move in the opposite direction.

📉 3. Divergence: A Momentum-Based Warning

Divergence occurs when price and an oscillator (like RSI or Stochastic) are telling two different stories.

-

Price makes a higher high, but the oscillator makes a lower high → bearish divergence

-

Price makes a lower low, but the oscillator makes a higher low → bullish divergence

-

Best Oscillators:

-

RSI (14) – widely used and effective

-

Stochastic (8,3,3) – alternative oscillator for confirmation

Divergence helps you avoid false entries by showing weakening momentum, even if price seems to be trending.

🔄 Hidden Divergence: For Trend Continuation

Hidden divergence works in the opposite direction:

-

Use it to confirm a trend continuation, not reversal.

-

In an uptrend: price makes a higher low, but oscillator shows a lower low

-

In a downtrend: price makes a lower high, but oscillator shows a higher high

Example of hidden bearish divergence in a downtrend — price makes lower high, oscillator makes higher high.

These setups are great for confirming pullbacks as re-entry points within an ongoing trend.

🧭 Putting It All Together

Use these reversal signs not in isolation, but as early warnings:

-

Confirm with candlestick patterns, multi-timeframe analysis, and support/resistance zones

-

Then use lower timeframes for precise entries

✅ Summary

| Reversal Signal | Description | Best Use Case |

|---|---|---|

| Head & Shoulders | Classic 3-peak pattern, signals a trend change | Break/retest entry on neckline |

| Double Top/Bottom | Price retests key high/low but fails | Bias shift confirmation before entries |

| Divergence | Price vs Oscillator disagreement | Detect hidden weakness or strength |

| Hidden Divergence | Confirms trend continuation | Low-risk entries in trending markets |

🚀 Final Thought

Most new traders get caught trying to “catch the top or bottom.” Instead, focus on identifying a potential reversal, wait for confirmation, and then align with the new momentum.

Trade smart, wait for your setup, and remember: the trend is your friend — until it ends.

English

English